Unlocking Financial Freedom: Is Gomyfinance.com The Saving Money App You Need?

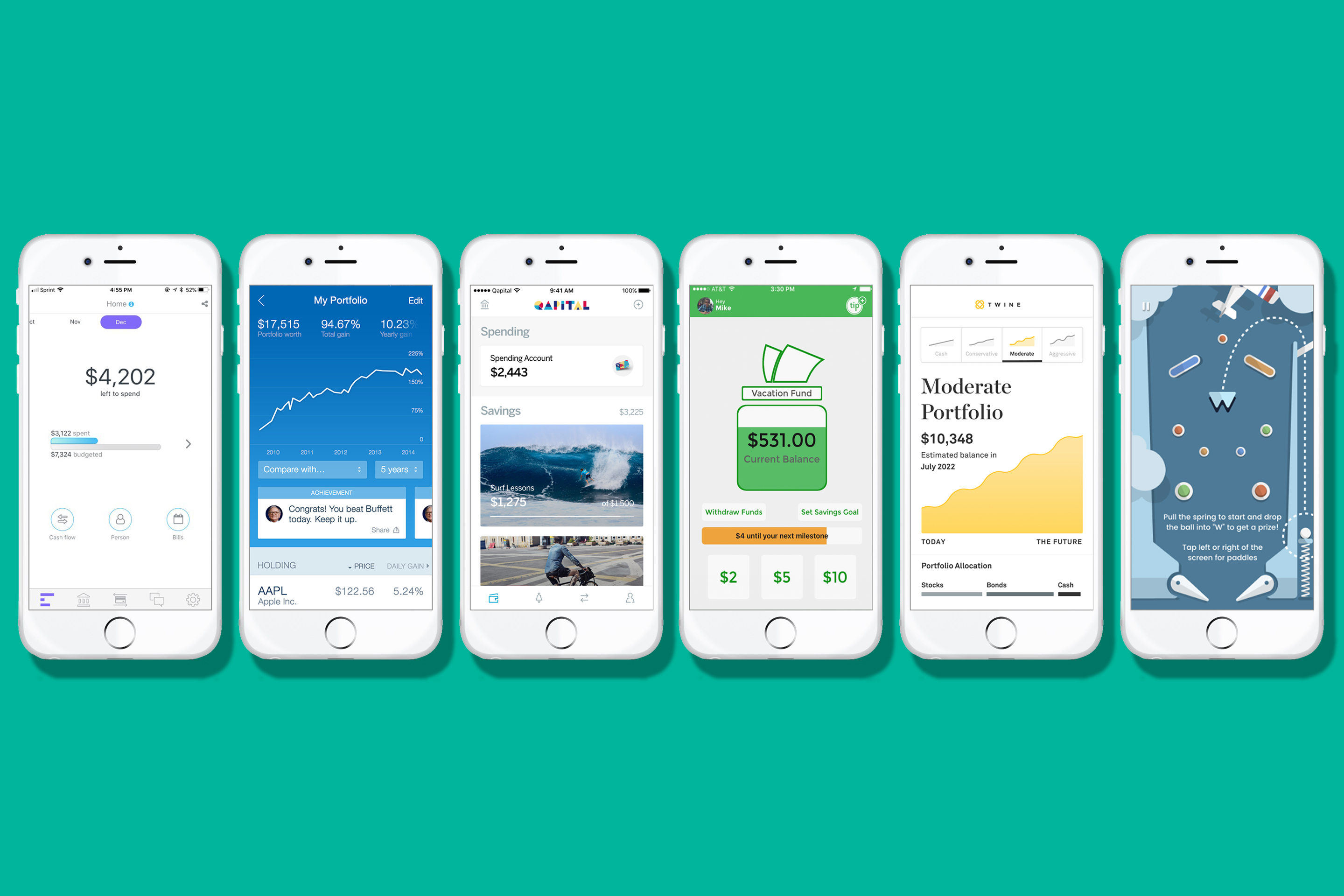

Are you tired of watching your hard-earned money slip through your fingers without a clear understanding of where it's going? Gomyfinance.com is revolutionizing personal finance, offering a streamlined, intuitive platform to take control of your financial destiny. In todays fast-paced world, managing finances effectively is more crucial than ever, and Gomyfinance.com emerges as an essential saving money app that helps users take control of their financial future. With the increasing cost of living and the need for better financial planning, individuals are constantly looking for tools that simplify saving and budgeting. Gomyfinance.com not only offers a platform for tracking expenses but also equips users with valuable insights for smarter financial decisions.

The landscape of personal finance is often fraught with complexity and confusion, leaving many individuals feeling overwhelmed and ill-equipped to make sound financial decisions. Gomyfinance.com aims to disrupt this paradigm by providing a user-friendly, feature-rich application that demystifies budgeting, expense tracking, and goal setting. This isnt just another budgeting app; its a comprehensive financial management tool designed to empower users at every stage of their financial journey. By offering clear, actionable insights derived from your own financial data, Gomyfinance.com helps you understand your spending habits, identify areas for improvement, and ultimately achieve your financial aspirations, whether it's saving for retirement, buying a home, or simply building a more secure financial foundation.

| Feature | Description |

|---|---|

| App Name | Gomyfinance |

| Founded | 2020 |

| Headquarters | United States |

| Website | gomyfinance.com |

| Platform | iOS, Android, Web |

This article will delve into the features, benefits, and user experiences of Gomyfinance.com, showcasing how this app can transform the way you save money. By the end of this comprehensive guide, youll understand why Gomyfinance.com is a go-to app for anyone serious about managing their finances effectively.

- Hells Angels Women Rules Roles Untold Stories

- Aww Drew Barrymore Corey Feldmans Touching Reunion Today

Whether youre a student trying to save for your first car or a family looking to budget for a home renovation, Gomyfinance.com provides the tools you need to achieve your financial goals. Lets explore how this app can revolutionize your approach to saving money and financial management.

- What is Gomyfinance.com?

- Key Features of Gomyfinance.com

- Benefits of Using Gomyfinance.com

- How to Get Started with Gomyfinance.com

- User Experience and Reviews

- Security and Privacy Measures

- Comparison with Other Saving Money Apps

What is Gomyfinance.com?

Gomyfinance.com is an innovative saving money app designed to help users track their expenses and savings efficiently. It serves as a personal finance management tool that allows you to set financial goals, monitor spending habits, and ultimately save more money over time. With its user-friendly interface and robust features, Gomyfinance.com caters to individuals and families alike, making it a versatile choice for financial management.

In an era dominated by digital solutions, Gomyfinance.com emerges as a beacon for individuals seeking to navigate the complexities of personal finance with ease and confidence. Unlike traditional budgeting methods that often rely on cumbersome spreadsheets and manual calculations, Gomyfinance.com offers a seamless, automated experience that empowers users to gain a comprehensive understanding of their financial landscape. Its core functionality revolves around providing a centralized platform for tracking income, expenses, and savings, allowing users to visualize their financial flows in real-time. By connecting directly to your bank accounts and credit cards, Gomyfinance.com automatically categorizes your transactions, eliminating the need for manual data entry and providing accurate insights into your spending habits.

- Margot Robbies Hottest Looks From Barbie To Beyond

- Will Smiths Kids At The Grammys Jaden Willows Unique Styles

Beyond mere expense tracking, Gomyfinance.com empowers users to set realistic financial goals, whether it's saving for a down payment on a house, paying off student loan debt, or building an emergency fund. The app's goal-setting feature allows you to define specific targets, track your progress, and receive personalized recommendations for achieving your objectives. By breaking down large financial goals into smaller, manageable milestones, Gomyfinance.com makes the process of saving and investing feel less daunting and more achievable. Furthermore, the app's robust reporting and analytics capabilities provide valuable insights into your spending patterns, enabling you to identify areas where you can cut back on unnecessary expenses and redirect funds towards your savings goals. With its intuitive interface and comprehensive features, Gomyfinance.com is more than just a budgeting app; it's a personal finance companion that helps you build a brighter financial future.

The app's commitment to accessibility is evident in its cross-platform availability, catering to users on iOS, Android, and web platforms. This ensures that individuals can manage their finances from virtually anywhere, whether they're at home, at work, or on the go. The seamless synchronization across devices further enhances the user experience, allowing you to access your financial data and make updates in real-time, regardless of the device you're using. In essence, Gomyfinance.com is designed to be an indispensable tool for anyone seeking to gain control of their finances and achieve their financial aspirations.

Key Features of Gomyfinance.com

Gomyfinance.com comes packed with features that promote effective financial management. Here are some of the key features that set it apart:

- Expense Tracking: Easily input and categorize your expenses to gain insights into your spending habits.

- Budgeting Tools: Create personalized budgets based on your income and financial goals.

- Goal Setting: Set savings goals for specific purchases or financial milestones.

- Real-Time Notifications: Receive alerts on your spending, helping you stay on track.

- Reports and Analytics: Generate reports to analyze your spending patterns over time.

The cornerstone of Gomyfinance.com's appeal lies in its comprehensive suite of features meticulously designed to empower users with unparalleled control over their financial lives. Central to its functionality is the expense tracking module, which simplifies the often-arduous task of recording and categorizing financial outlays. Unlike traditional methods that rely on manual data entry, Gomyfinance.com seamlessly integrates with your bank accounts and credit cards, automatically importing transaction data and categorizing it based on predefined rules. This automated approach not only saves time and effort but also ensures accuracy, providing a clear and comprehensive picture of your spending habits.

Beyond expense tracking, Gomyfinance.com offers a robust array of budgeting tools that enable users to create personalized financial plans tailored to their unique circumstances and goals. The app allows you to set spending limits for various categories, such as groceries, entertainment, and transportation, helping you stay within your means and avoid overspending. Moreover, Gomyfinance.com provides real-time feedback on your budget adherence, alerting you when you're approaching or exceeding your spending limits. This proactive approach empowers you to make informed decisions about your spending and adjust your budget as needed, ensuring that you remain on track to achieve your financial objectives.

Furthermore, Gomyfinance.com's goal setting feature is a powerful tool for motivating users to save and invest for the future. Whether you're saving for a down payment on a house, paying off debt, or building a retirement nest egg, the app allows you to define specific financial goals, track your progress, and receive personalized recommendations for achieving your objectives. By breaking down large financial goals into smaller, manageable milestones, Gomyfinance.com makes the process of saving and investing feel less daunting and more achievable. The app also provides visual representations of your progress, allowing you to see how far you've come and stay motivated along the way.

To further enhance the user experience, Gomyfinance.com incorporates real-time notifications that keep you informed about your spending and savings activities. These notifications can be customized to alert you when you've exceeded your budget limits, when a large transaction has been processed, or when you're nearing a savings milestone. By providing timely and relevant information, Gomyfinance.com helps you stay on top of your finances and make informed decisions in the moment. Finally, the app's reports and analytics capabilities provide a comprehensive overview of your financial performance over time. You can generate detailed reports that analyze your spending patterns, track your progress towards your financial goals, and identify areas where you can improve your financial management. These reports can be customized to display data in a variety of formats, such as charts, graphs, and tables, making it easy to visualize your financial situation and identify trends.

Benefits of Using Gomyfinance.com

The advantages of utilizing Gomyfinance.com extend beyond mere expense tracking. Some of the notable benefits include:

- Improved Financial Awareness: Gain a clearer understanding of where your money goes each month.

- Increased Savings: By identifying unnecessary expenditures, users can redirect funds towards their savings goals.

- User-Friendly Interface: The app is designed for ease of use, making financial management accessible to everyone.

- Customization: Tailor the apps features to fit your unique financial situation and goals.

The true value proposition of Gomyfinance.com lies in its ability to deliver tangible benefits to users, transforming their financial lives for the better. Foremost among these benefits is improved financial awareness. By providing a comprehensive overview of your income, expenses, and savings, Gomyfinance.com empowers you to gain a clearer understanding of where your money goes each month. This increased awareness is crucial for identifying areas where you can cut back on unnecessary spending and redirect funds towards your savings goals. With Gomyfinance.com, you're no longer in the dark about your finances; you have a clear and accurate picture of your financial situation at your fingertips.

Building upon this foundation of financial awareness, Gomyfinance.com facilitates increased savings. By identifying unnecessary expenditures and providing tools for setting and tracking savings goals, the app helps users redirect funds towards their financial aspirations. Whether you're saving for a down payment on a house, paying off debt, or building a retirement nest egg, Gomyfinance.com empowers you to make informed decisions about your spending and savings, ensuring that you're on track to achieve your financial objectives. The app's real-time notifications and personalized recommendations further enhance your ability to save, providing timely reminders and suggestions for optimizing your financial habits.

The user-friendly interface of Gomyfinance.com is another key benefit, making financial management accessible to everyone, regardless of their technical expertise or financial literacy. The app's intuitive design and clear navigation make it easy to track expenses, create budgets, set goals, and generate reports. Even users who are new to budgeting and personal finance will find Gomyfinance.com easy to use and understand. The app's commitment to simplicity and accessibility ensures that everyone can take control of their finances and achieve their financial goals.

Finally, Gomyfinance.com offers a high degree of customization, allowing you to tailor the app's features to fit your unique financial situation and goals. You can create custom categories for your expenses, set personalized budget limits, and define specific savings goals. The app also allows you to customize the frequency and type of notifications you receive, ensuring that you're always informed about your financial activities without being overwhelmed. This level of customization ensures that Gomyfinance.com is a truly personalized financial management tool that adapts to your individual needs and preferences. In essence, Gomyfinance.com is more than just a budgeting app; it's a comprehensive financial management solution that empowers you to take control of your finances, achieve your financial goals, and build a brighter financial future.

How to Get Started with Gomyfinance.com

Ready to take control of your finances? Heres how to get started with Gomyfinance.com:

- Download the App: Available on iOS and Android, download the app to your smartphone or access it via the web.

- Sign Up: Create an account using your email and set a secure password.

- Set Your Goals: Define your financial goals and budget preferences.

- Input Your Expenses: Begin tracking your expenses to get a comprehensive view of your finances.

Embarking on your journey towards financial empowerment with Gomyfinance.com is a seamless and straightforward process, designed to get you up and running in no time. The first step is to download the app, which is readily available on both iOS and Android platforms, ensuring accessibility for a wide range of smartphone users. Alternatively, you can access Gomyfinance.com via the web on your computer, providing flexibility and convenience. The choice is yours, depending on your preferred method of accessing and managing your finances.

Once you've downloaded the app or accessed the web version, the next step is to sign up for an account. This involves providing your email address and setting a secure password. It's crucial to choose a strong password that you don't use for other online accounts, as this will help protect your financial information from unauthorized access. Gomyfinance.com employs advanced encryption methods to safeguard your data, but it's always prudent to take extra precautions to ensure the security of your account.

After creating your account, the next step is to set your goals. This involves defining your financial aspirations and budget preferences. Whether you're saving for a down payment on a house, paying off debt, or building a retirement nest egg, Gomyfinance.com allows you to set specific financial goals, track your progress, and receive personalized recommendations for achieving your objectives. The app also allows you to set budget limits for various spending categories, helping you stay within your means and avoid overspending. Defining your goals and budget preferences is a crucial step in taking control of your finances and setting yourself up for success.

Finally, the last step is to input your expenses. This involves tracking your spending to get a comprehensive view of your finances. Gomyfinance.com makes this process easy by allowing you to connect your bank accounts and credit cards, automatically importing transaction data and categorizing it based on predefined rules. Alternatively, you can manually enter your expenses if you prefer. The key is to be diligent in tracking your spending, as this will provide you with valuable insights into your financial habits and help you identify areas where you can cut back on unnecessary expenditures. With Gomyfinance.com, tracking your expenses is no longer a chore; it's a simple and automated process that empowers you to gain control of your finances and achieve your financial goals.

User Experience and Reviews

User experience is crucial when it comes to financial apps. Gomyfinance.com has received positive feedback from users who appreciate its simplicity and effectiveness. Heres what some users have to say:

- Ease of Use: Many users highlight the intuitive design, making it easy for anyone to navigate.

- Effective Budgeting: Users have reported significant improvements in their saving habits after using the app.

- Customer Support: The customer service team is responsive and helpful, assisting users with any issues.

In the realm of financial applications, user experience reigns supreme, serving as the linchpin upon which success or failure hinges. Gomyfinance.com has garnered commendations from its user base, who extol its simplicity and efficacy. These positive sentiments underscore the app's commitment to providing a seamless and intuitive experience for individuals seeking to gain control of their finances.

The ease of use of Gomyfinance.com is a recurring theme in user reviews, with many highlighting the app's intuitive design as a key factor in their positive experience. The app's clear navigation, uncluttered interface, and logical workflow make it easy for anyone to track expenses, create budgets, set goals, and generate reports, regardless of their technical expertise or financial literacy. This accessibility is particularly important for users who are new to budgeting and personal finance, as it eliminates the intimidation factor and makes the process of managing their finances feel less daunting.

Beyond its user-friendly design, Gomyfinance.com has also been praised for its effective budgeting capabilities. Many users have reported significant improvements in their saving habits after using the app, attributing this success to the app's ability to provide clear insights into their spending patterns and help them identify areas where they can cut back on unnecessary expenditures. The app's budgeting tools, such as spending limits and real-time notifications, further enhance its effectiveness, empowering users to stay within their means and avoid overspending. The positive feedback from users regarding the app's budgeting capabilities underscores its value as a tool for achieving financial goals.

Finally, Gomyfinance.com has received accolades for its responsive and helpful customer support. Users have reported that the customer service team is quick to address their inquiries and assist them with any issues they may encounter while using the app. This commitment to customer satisfaction is a testament to Gomyfinance.com's dedication to providing a positive user experience. The availability of reliable customer support can be particularly important for users who are new to budgeting and personal finance, as it provides them with a safety net and ensures that they can get the help they need when they need it.

Security and Privacy Measures

Security is a top priority at Gomyfinance.com. The app employs advanced encryption methods to protect user data and financial information. Users can feel confident that their sensitive information is secure while using the app. Additionally, Gomyfinance.com adheres to strict privacy policies, ensuring that user data is never sold or shared without consent.

In the digital age, where data breaches and privacy concerns are increasingly prevalent, security has emerged as a paramount consideration for users of financial applications. Gomyfinance.com recognizes the gravity of this issue and has made security a top priority, implementing a robust array of measures to protect user data and financial information. These measures encompass advanced encryption methods, adherence to stringent privacy policies, and ongoing security audits.

To safeguard user data during transmission and storage, Gomyfinance.com employs advanced encryption methods. This ensures that sensitive information, such as bank account details, credit card numbers, and transaction data, is protected from unauthorized access. The app utilizes industry-standard encryption protocols to encrypt data both in transit and at rest, providing a robust layer of security that prevents hackers from intercepting or deciphering user information. This commitment to encryption is a cornerstone of Gomyfinance.com's security strategy.

Beyond encryption, Gomyfinance.com adheres to strict privacy policies that govern the collection, use, and sharing of user data. The app is committed to protecting user privacy and ensures that user data is never sold or shared with third parties without consent. Gomyfinance.com collects only the information necessary to provide its services and uses this information solely for the purpose of helping users manage their finances. The app also provides users with the ability to control their privacy settings and opt out of certain data collection practices. This commitment to privacy is a testament to Gomyfinance.com's respect for user rights.

To further bolster its security posture, Gomyfinance.com conducts ongoing security audits to identify and address potential vulnerabilities. These audits are performed by independent security experts who assess the app's security controls and identify areas where improvements can be made. The results of these audits are used to enhance the app's security measures and ensure that it remains protected against emerging threats. This commitment to ongoing security audits demonstrates Gomyfinance.com's proactive approach to security and its dedication to maintaining a secure environment for its users. With its comprehensive security and privacy measures, Gomyfinance.com provides users with the peace of mind that their financial information is safe and protected.

Comparison with Other Saving Money Apps

When comparing Gomyfinance.com to other saving money apps, it stands out for its comprehensive features and user-friendly design. Unlike some apps that focus solely on expense tracking, Gomyfinance.com combines budgeting, goal setting, and reporting, providing a holistic financial management experience. Heres a quick comparison:

| App Name | Expense Tracking | Budgeting | Goal Setting | Reports |

|---|---|---|---|---|

| Gomyfinance.com | Yes | Yes | Yes | Yes |

| App A | Yes | No | No | Limited |

| App B | No | Yes | Limited | Yes |

In the crowded landscape of saving money apps, Gomyfinance.com distinguishes itself through its comprehensive feature set, intuitive design, and holistic approach to financial management. Unlike some apps that focus solely on expense tracking, Gomyfinance.com seamlessly integrates budgeting, goal setting, and reporting, providing users with a unified platform for managing their finances. This comprehensive approach sets it apart from its competitors and makes it a compelling choice for individuals seeking to gain control of their financial lives.

While many saving money apps offer expense tracking capabilities, Gomyfinance.com goes above and beyond by automating the process and providing detailed insights into spending patterns. The app seamlessly integrates with bank accounts and credit cards, automatically importing transaction data and categorizing it based on predefined rules. This automated approach saves time and effort and ensures that users have a clear and accurate picture of their spending habits. In contrast, some expense tracking apps rely on manual data entry, which can be time-consuming and prone to errors.

Beyond expense tracking, Gomyfinance.com offers robust budgeting tools that enable users to create personalized financial plans tailored to their unique circumstances and goals. The app allows users to set spending limits for various categories, such as groceries, entertainment, and transportation, helping them stay within their means and avoid overspending. Moreover, Gomyfinance.com provides real-time feedback on budget adherence, alerting users when they're approaching or exceeding their spending limits. This proactive approach empowers users to make informed decisions about their spending and adjust their budget as needed. In contrast, some budgeting apps offer limited budgeting features or lack the real-time feedback that is essential for effective budget management.

Furthermore, Gomyfinance.com's goal setting feature is a powerful tool for motivating users to save and invest for the future. Whether users are saving for a down payment on a house, paying off debt, or building a retirement nest egg, the app allows them to define specific financial goals, track their progress, and receive personalized recommendations for achieving their objectives. This goal-oriented approach helps users stay focused and motivated, making the process of saving and investing feel less daunting and more achievable. In contrast, some saving money apps lack goal setting features altogether or offer only limited goal setting capabilities.

Finally, Gomyfinance.com provides comprehensive reports that offer valuable insights into financial performance over time. Users can generate detailed reports that analyze spending patterns, track progress towards financial goals, and identify areas where improvements can be made. These reports can be customized to display data in a variety of formats, such as charts, graphs, and tables, making it easy to visualize financial situations and identify trends. In contrast, some saving money apps offer limited reporting capabilities or lack the ability to customize reports to meet specific needs. With its comprehensive features, intuitive design, and holistic approach to financial management, Gomyfinance.com stands out as a superior choice in the crowded landscape of saving money apps.

Detail Author:

- Name : Will Wolff

- Username : monahan.lesly

- Email : elliot19@gmail.com

- Birthdate : 1996-02-10

- Address : 964 Una Inlet Apt. 163 West Jeffery, IL 37156-1319

- Phone : +17694673899

- Company : Altenwerth, Mueller and Cremin

- Job : Veterinary Assistant OR Laboratory Animal Caretaker

- Bio : Hic aut harum ut earum saepe quas. Dolore hic porro aut excepturi nulla. Ut laudantium reprehenderit non officia recusandae.

Socials

twitter:

- url : https://twitter.com/mccullougha

- username : mccullougha

- bio : In voluptatibus hic possimus dolore ducimus. Voluptatibus sequi dolore quia iure atque delectus iusto. Repellat ut deserunt iste vero ab dolorum sunt.

- followers : 3739

- following : 1704

tiktok:

- url : https://tiktok.com/@mccullougha

- username : mccullougha

- bio : Rerum neque vitae quis et ad consequatur.

- followers : 1032

- following : 2067

instagram:

- url : https://instagram.com/abemccullough

- username : abemccullough

- bio : Sit aliquam dicta expedita eos at perspiciatis libero. Aut id et soluta ea quae amet enim.

- followers : 4301

- following : 2082

facebook:

- url : https://facebook.com/abe.mccullough

- username : abe.mccullough

- bio : Voluptate et repellendus consectetur iure vitae.

- followers : 1137

- following : 501